Perhaps naively so, but I believe that social media is a net positive. Free speech should be encouraged even if it means that we have to listen to or read speech that you can’t believe others would make. This type of speech usually falls into one of two categories (stupid or offensive) but often checks both boxes.

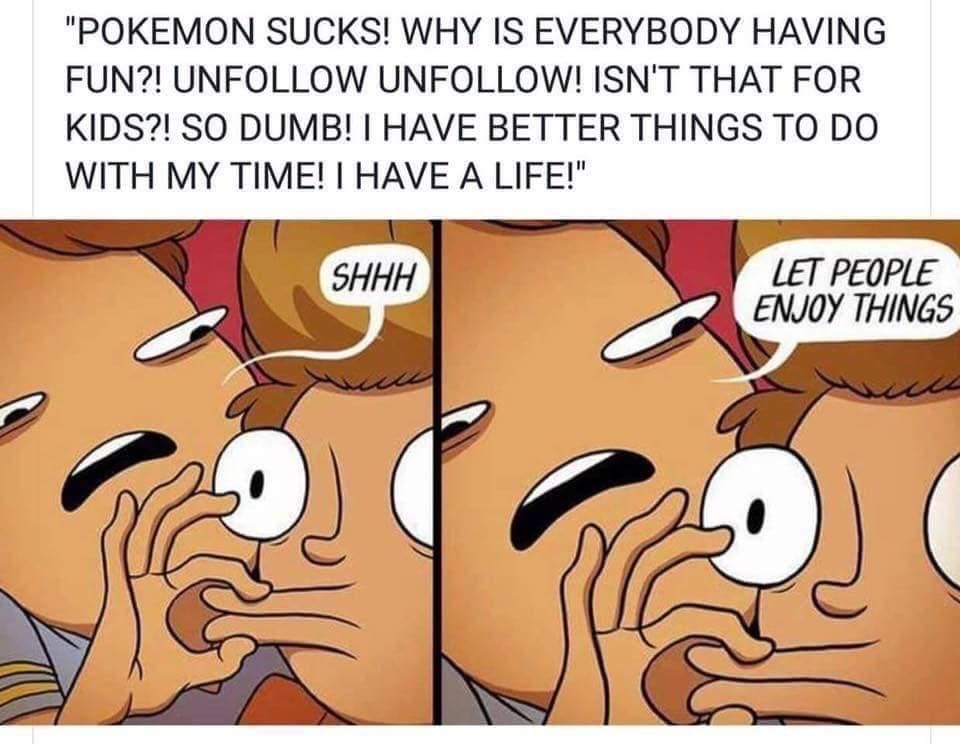

The thing that really blows my mind after 15 years of social media experience is how quick people are to condemn others for what they like. You see it every day, the same person who reposts every fat-ass, country cookbook, dump cake with potato-chip icing recipe will condemn someone else for enjoying what they like. It’s a knee-jerk (emphasis on the jerk) reaction to discomfort or lack of shared interests, and it always gets huge social approval.

Last week a friend’s kid who used to be overweight posted a gym selfie update where he showed the fruits of his labors. He’s lost weight, trimmed his physique, built muscle and improved what was important to him. Others commented that he shouldn’t be so vain and that gyms selfies were worse than the Holocaust. Ok, I made the last part up but the sentiment was nasty and dismissive nonetheless.

The only right answer was “Yes, son! Get after it! Be you and be proud of who you become!” Full stop. Nothing else is permissible.

Let people enjoy what they enjoy. Keep your low-minded, poverty-oriented, self-focused comments to yourself. It doesn’t matter. It only hurts, never helps. If all you have to offer is criticism of another’s enjoyment follow my four simple rules for fixing your social media presence:

Shut.

The.

F.

Up.

It might be a new experiment for some of you, but try it. I don’t know if it will make you happier, thinner, richer or better looking, but it sure will improve life for the rest of us.

“The self does not lie passively in wait for us to discover it. Self is made in the active, ongoing process that happens inside the verb ‘to become.’”

—John Kaag

When capital is plentiful, its wasted on pursuits that the market doesn’t value. When everyone has an extra dollar, those dollars go to things they wouldn’t if money was tight. The last 40-ish years was a period of capital growth, where more money found its way into more pockets to be spent on all manner of interests and projects. This process is now reversing itself. Over the next 40 years (1/2 of a turning for Levi-Strauss fans), capital will be increasingly difficult to acquire, deploy and this means that choices will be made as to where society allocates a newly precious resource.

We are seeing the changes happen now, if you know where to look for them. One example that struck me this last week was the newly proposed budget at West Virginia University (see? the small point shows the larger point). The University is cutting 169 faculty position in 32 major programs and even eliminating whole departments where students are simply not showing up to learn the subject material. The Department of World Languages is gone, as are many graduate level programs in higher education administration. These are the kind of things that Universities offer because they have professors to teach them, not because they have students who want to take them.

Equally interesting though, is the fact that the University is also reducing faculty and program availability in some fields of study that seem counter-intuitive like Computer Science, Electrical Engineering, and Mining Engineering. It recognizes that as technology progresses, we need to produce less of those who can hand-code software, and more of those who can apply technology to real problems instead.

The Ivory Tower cannot survive the resetting of an economy into capital scarcity. In the very near future, Universities will lean down on programs that students won’t pay for, or, more accurately, for which students can’t source at a sufficient level of quality elsewhere. This should add up to declining tuition costs as an absolute result over time, as it should. College Tuition has a historical CAGR of about 12-15%, all supported by the cheap debt guaranteed by the government.

The Universities have had a good run, but I don’t anticipate my kids having the same experience in higher education that I had not so many years ago.

“When you’re a leader, people are going to mimic your behavior at a minimum. It’s a guarantee and Calm is contagious.”

-Pavel Tsatsouline

An economist recently did a deep-dive-deconstruct of why Americans feel like the economy is in a bad place as indicated by Consumer Sentiment measurements. As a refresher, Americans now think that the economy is worse than any time except for 1980 when no one who wanted to work could find a job, and in 2008 when asset prices melted down because there was no borrowable money to shore them up.

Really guys? Real wages have increased significantly in the last 3 years, and unemployment is now solely a matter of choice. If these are true and sentiment is still so low, you have to ask deeper questions as to how those two things can be true. What has changed that wasn’t true in 1980 and 2008?

House prices are going up on historically comparative charts, and the cost to borrow money is rising now, as well. In other words, as Americans it’s simply almost always been true that if you had a job and saved just enough money, you could move to a nicer neighborhood and easily finance that move with a mortgage. Now, however, with historically low inventory rates of real estate for sale, and with the tightening in the credit markets for mortgages, Americans are being told no for the first time time since 2008.

On the whole Americans will suffer any kind of national political foolishness. Everyone professed to care that Clinton acted inappropriately with an intern, and then criminally in denying it, but no one did much about it. Why? Because they could find homes and afford them. They had lives and goals and things to do, and the politics of the Arkansas Crier was on the list of things to notice, but not to care about. Since 2016, the level of foolishness has only increased as the Orange One said and did every outrageous thing, was accused of doing even more and then handed it over to a guy who can’t find the exit on a raised dais with realiability. It’s all terribly ridiculous, and no one has cared … until now.

Now, even if you have the money, you can’t find the next good home for you and your family, and even if you did, you can’t finance it on advantageous terms. This is a break in the social covenant so deeply held that we never talk about it. The national politicos can keep going with their shenanigans but they underestimate the upshot of this over a very short time.

Bring back cheap mortgages, increasing asset prices, and bring down real wages and inflation in consumer goods. Do it by legal methods of legislation and regulation, and not by fiat or there will be hell to pay.